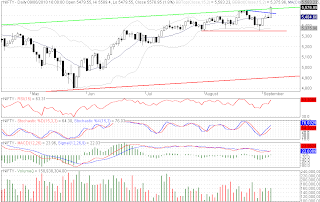

On Wednesday, market opened gap-up near day resistance level but failed to hold, which lead to huge sell-off in market thru out the day. Oil & Gas, Metals, Realty and FMCG remain under selling pressure whereas IT and banking counters remain under profit booking. Market breadth was negative. Midcap & Smallcap index close in red. Indicator RSI closed at 71.30 breaking neckline level near 74 of H&S pattern which will target RSI at 64 and 52 in coming days.

For the day, the level of 5975 and 5960 may act as a major support

for the market and the level of 6005 and 6020 may act as a major hurdle. Mostly all technical indicators are in an overbought zone with some showing negative divergence so one needs to remain cautious.

The short term trend will turn negative below the level of 5945.

Day trader can go long on nifty above 6005 with stop loss 5990 for

target 6020 / 6045 and can go short below 5975 with stop loss 5990

for target 5960 / 5935.

INDEX RANGE

NIFTY: 5991.30

Range: 5990-6070

Resistance: 6005-6020-6045

Support: 5975-5960-5935

BANK NIFTY: 12237.50

Range: 12085-12395

Resistance: 12295-12350-12395

Support: 12185-12130-12085

Resistance: 12295-12350-12395

Support: 12185-12130-12085

Short term: Up (5945)

Medium term: UP (5630)

Long term: Up (5180)

Long term: Up (5180)

All Above Spot Levels

OM SHRI GANESHAYA NAMAH