Tuesday, May 11, 2010

NIFTY ::: SWING VOLUME PATTERN CHART ::: UPDATE ::: RISE WOULD NOT BE SUSTAINABLE

::: SWING VOLUME PATTERN CHART :::

:::: ITS ALL ABOUT VOLUME GAME ::::

:::: ITS ALL ABOUT VOLUME GAME ::::

DATE NSE VOLUME

5th May 2010 207,679,138

6th May 2010 192,105,707

7th May 2010 233,345,722

10th May 2010 191,632,764

AS PER THE OBSERVATION / STUDY ON SVP CHART

TODAY'S VOLUME IS LESS THEN LAST THREE TRADING SESSION'S

WHICH INDICATE RISE WOULD NOT BE SUSTAINABLE

THE PICTURE WOULD BE CLEAR BY TOMORROW I.E. 11TH MAY 2010

AS TOLD ALREADY TOMORROW SELLING ON MARKET EXPECTED IN SECOND HALF

THERE WOULD BE NO GAP-UP OPENING .. MARKET SHOULD OPEN AND TRADE NEAR TODAY CLOSE

WE KEEP OUR DOWNSIDE TARGET ON NIFTY OF 4900 INTACT

THOSE STUCK ON IN OLD LONGS USE RISE TO EXIT FOR RE-ENTRING AT LOWER LEVELS

Astro View on Nifty : 11th May 2010

•The days in May when Nifty will be highly volatile- 11,17,18,20,31.

(Keep in mind that the yearly weightage "5201" is not supporting the Nifty)

(Keep in mind that the yearly weightage "5201" is not supporting the Nifty)

•Investors can slowly buy till May 19, 2010. •Till 11:00 – Barring a significant jump somewhere along the way, Ganesha is likely to bring you back to where you started. So even if it's a margin of a rupee, keep exiting.

•11:00 to 12:20- Nifty is likely to go up.

•12:20 to 12:50- Nifty will experience some selling pressure.

•12:50 to the end of the trading day – The trend will change every 25 minutes. You may experience a bit of hammering in the middle. However, the stock market will show strength in almost the entire period.

•11:00 to 12:20- Nifty is likely to go up.

•12:20 to 12:50- Nifty will experience some selling pressure.

•12:50 to the end of the trading day – The trend will change every 25 minutes. You may experience a bit of hammering in the middle. However, the stock market will show strength in almost the entire period.

Source: GaneshaSpeaks

Monday, May 10, 2010

SENSEX / GLOBAL MARKET UPDATE BY : Colin Twiggs ::: EU Rescue But China Slides

By Colin Twiggs ::: May 10, 2010 5:00 a.m. ET (7:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice.

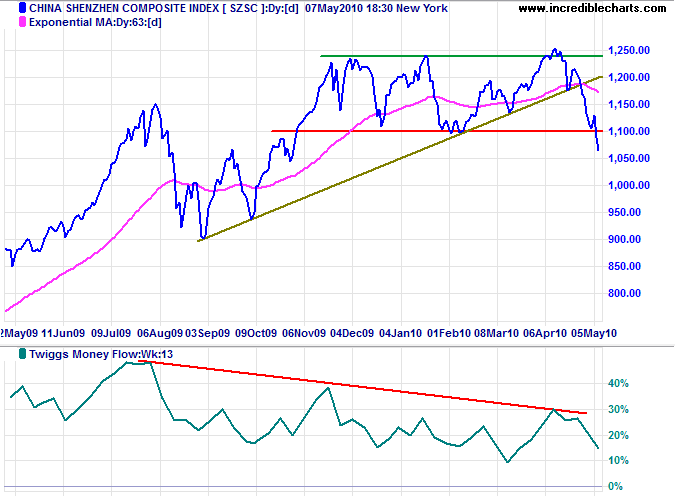

The €750 billion stabilization fund announced by the EU and IMF fueled a small rally in Asian stocks. The Shenzhen Composite Index, however, has broken primary support at 1100 to confirm the Shanghai Composite and Hang Seng primary down-trend. Bearish divergence on Twiggs Money Flow (13-week) indicates selling pressure.

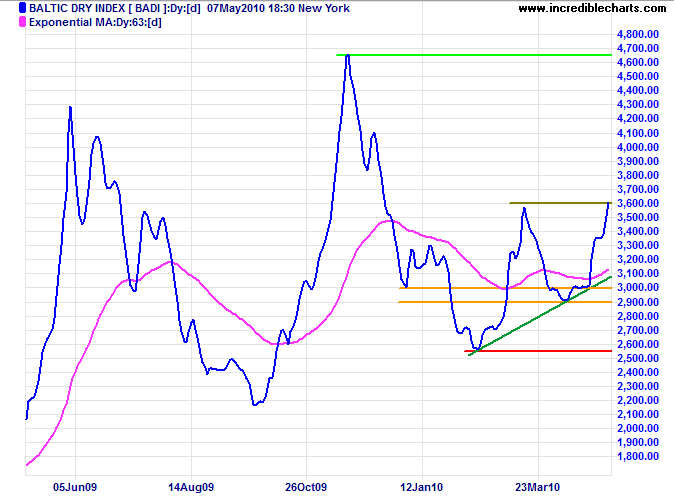

Commodities & Resources Stocks

Demand for commodities is so far unaffected by the Chinese down-turn, with the Baltic Dry Index testing medium-term resistance at 3600. Breakout would signal a fresh primary advance, implying rising demand for dry bulk shipping — primarily iron ore and coal to China. Reversal below 2550, however, would warn of a primary down-trend (if confirmed by the Baltic Panamax Index) and bear market for resources stocks.

USA

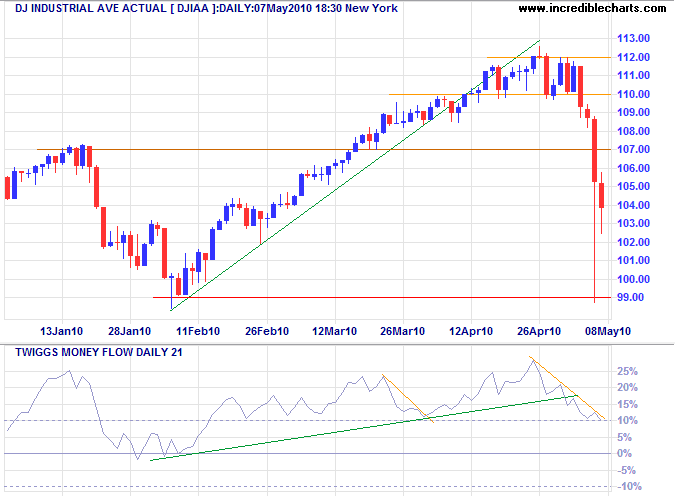

Dow Jones Industrial Average

Despite some dodgy trades doing their best to spook the market, the Dow failed to break primary support at 9900. Expect a rally to test short-term resistance at 10700, followed by another, weaker, test of 9900. The index, however, remains in a primary up-trend.

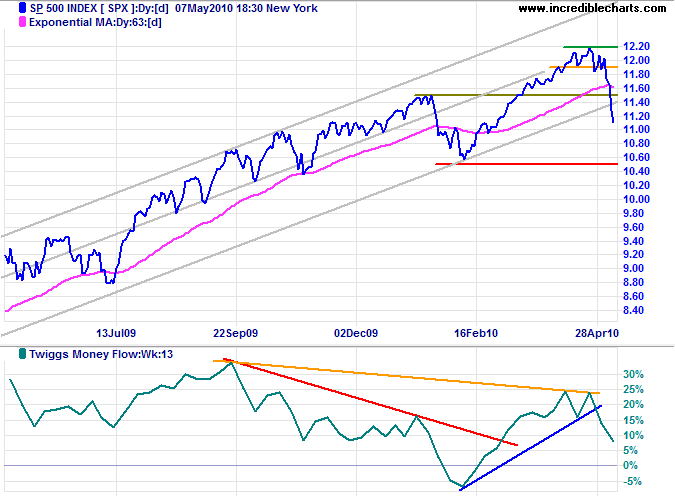

S&P 500

S&P 500 is also undergoing a correction. Expect a rally to test short-term resistance at 1150.

* Target calculation: 1150 + ( 1150 - 1050 ) = 1250

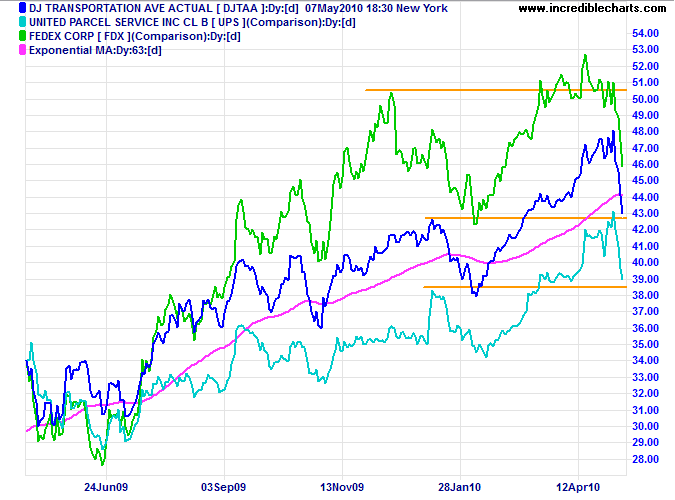

Transport

Transport indicators corrected sharply, but remain in a primary up-trend.

* Target calculation: 4300 + ( 4300 - 3800 ) = 4800

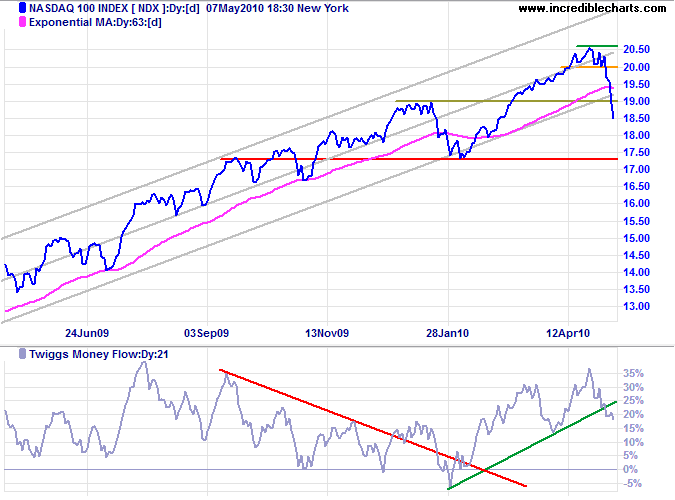

Technology

The Nasdaq 100 remains in a primary up-trend and is likewise expected to rally, forming short-term support at 1850.

* Target calculation: 1900 + ( 1900 - 1750 ) = 2050

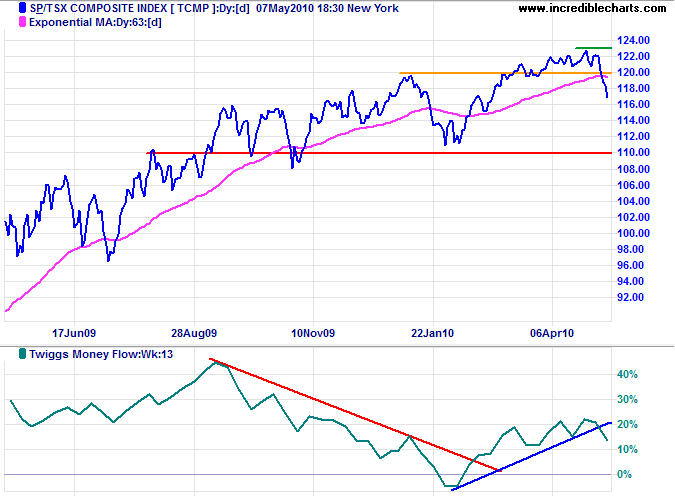

Canada: TSX

The TSX Composite also remains in a primary up-trend. Expect a rally to test resistance at 12000, but the correction is not yet over.

* Target calculation: 12000 + ( 12000 - 11000 ) = 13000

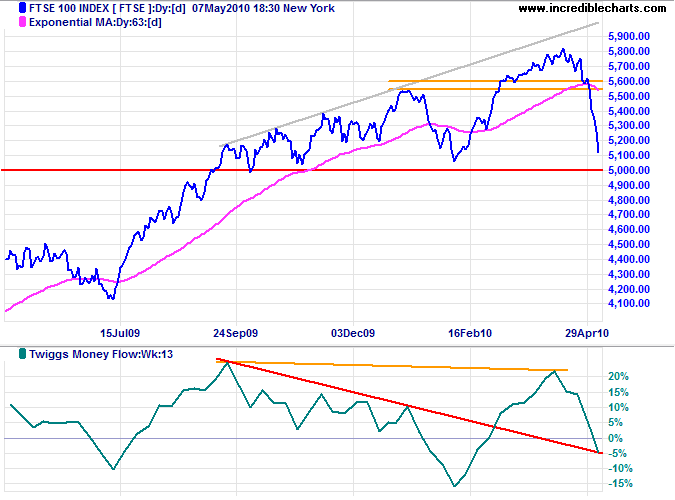

United Kingdom: FTSE

The FTSE 100 faces more severe selling pressure, with Twiggs Money Flow (13-week) crossing to below zero. Failure of support at 5000 would signal a primary down-trend.

* Target calculation: 5500 + ( 5500 - 5000 ) = 6000

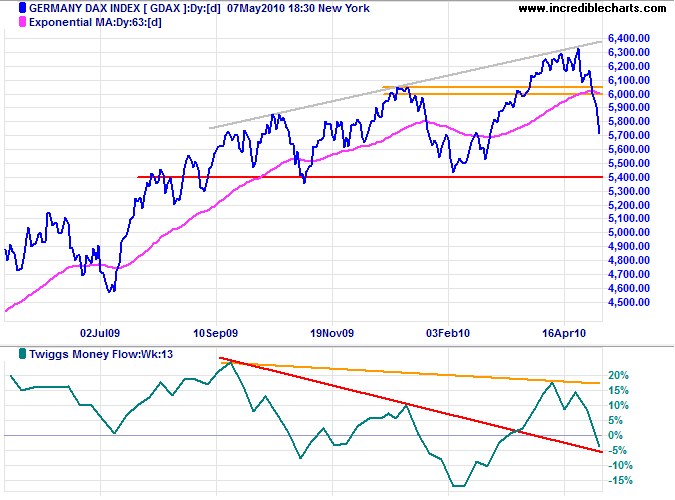

Germany: DAX

The DAX may rally to test resistance at 6000, but Twiggs Money Flow (13-week) below zero warns of another test of primary support at 5400.

* Target calculation: 6000 + ( 6000 - 5400 ) = 6600

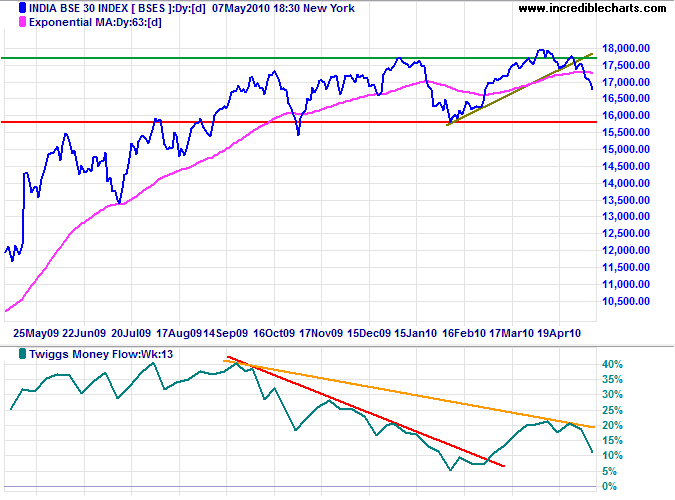

India: Sensex

The Sensex is testing resistance at 17250 Monday, but the correction is not yet over. Bearish divergence on Twiggs Money Flow (13-week) continues to warn of selling pressure. In the long term, reversal below 15800 would signal a primary down-trend, while recovery above 18000 would indicate an advance to 19800*.

* Target calculation: 17800 + ( 17800 - 15800 ) = 19800

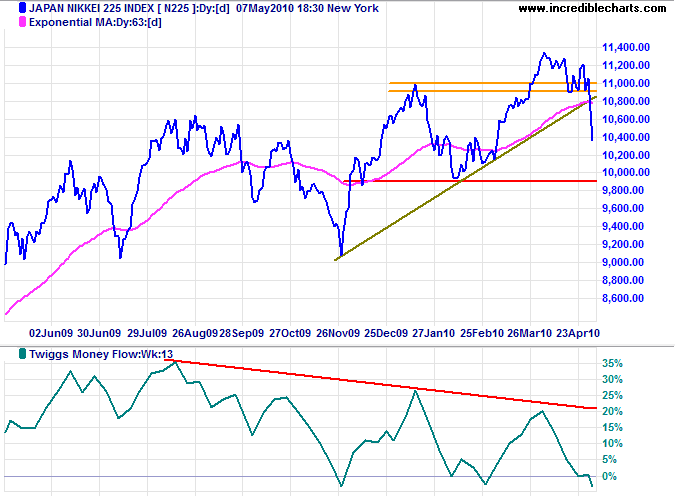

Japan: Nikkei

The Nikkei 225 rallied to 10500 Monday, but triple bearish divergence on Twiggs Money Flow (13-week) warns of strong selling pressure. Failure of support at 9900 would confirm a primary down-trend.

* Target calculation: 11000 + ( 11000 - 10000 ) = 12000

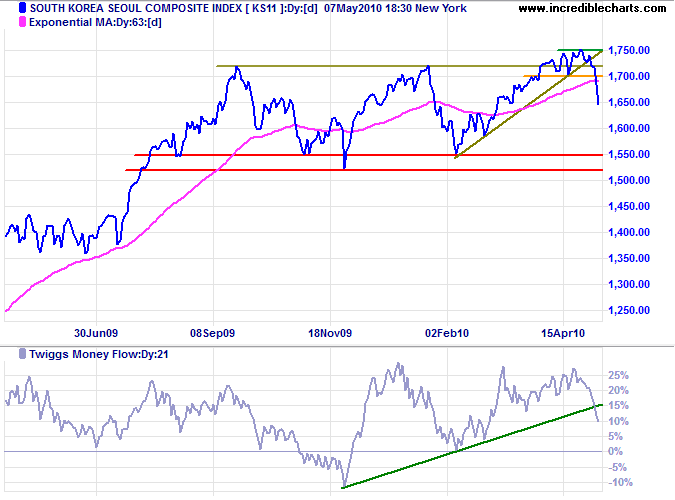

South Korea

The Seoul Composite rallied to 1680 Monday and is likely to test resistance at 1700. Twiggs Money Flow (21-day) small break of the rising trendline indicates a relatively mild correction. Recovery above 1750 would signal an advance to 1900*.

* Target calculation: 1720 + ( 1720 - 1550 ) = 1910

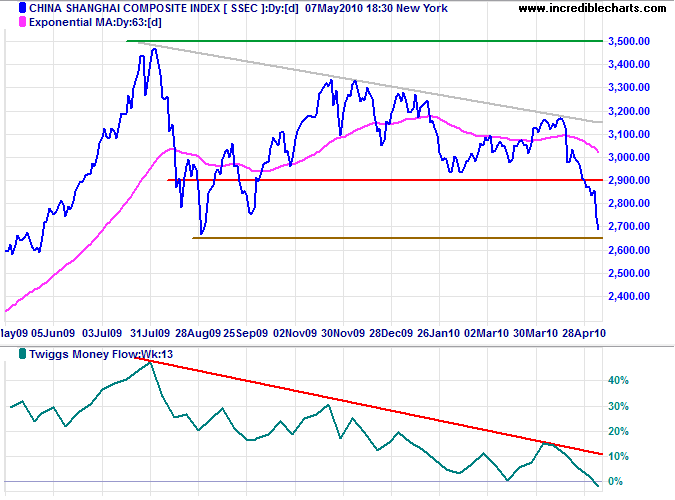

China

The Shanghai Composite Index is in a primary down-trend. Breakout below the August 2009 low of 2650 would confirm. Twiggs Money Flow (13-week) reversal below zero warns of selling pressure.

* Target calculations: 2900 - ( 3150 - 2900 ) = 2650

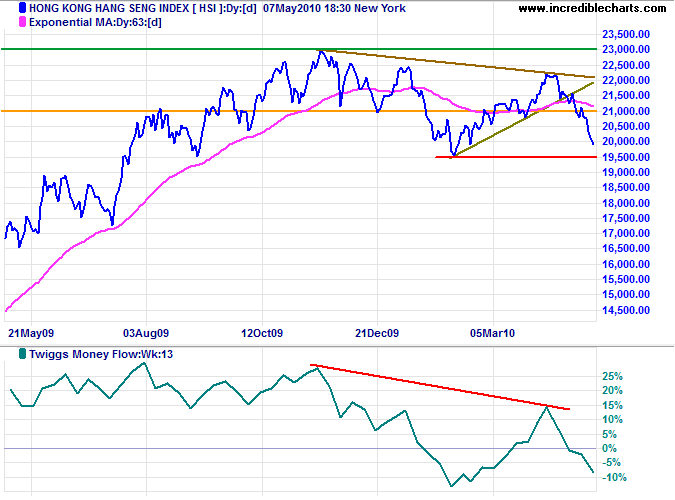

The Hang Seng Index rallied to 20500 on Monday. Expect a test of 21000, but the index remains in a primary down-trend. Twiggs Money Flow (13-week) reversal below zero warns of selling pressure. Failure of 19500 would offer a target of the July 2009 low at 17000*.

* Target calculations: 19500 - ( 22000 - 19500 ) = 17000

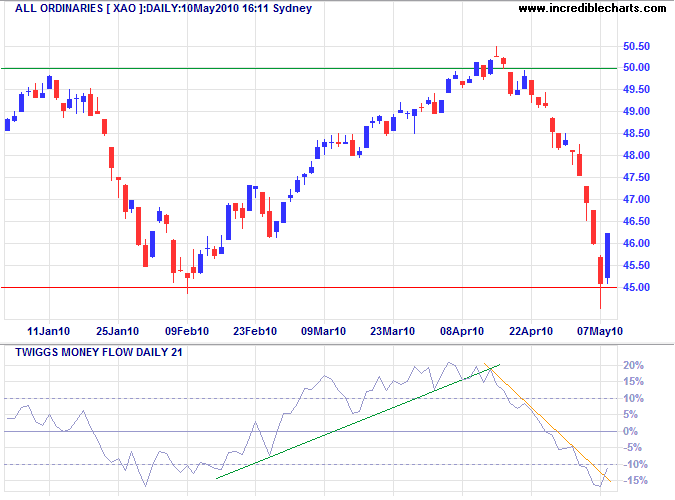

Australia: ASX

The All Ordinaries rallied off primary support at 4500 and Twiggs Money Flow (21-day) reversed above the declining trendline, but this does not necessarily mean the end of the correction. Another test that respects 4500 accompanied by bullish divergence on Twiggs Money Flow would, however, provide reasonable assurance.

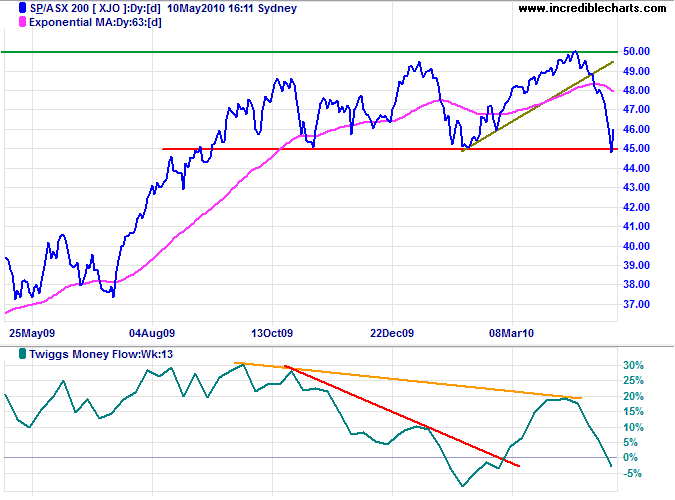

The long term picture remains bearish, however, with ASX 200 Twiggs Money Flow (13-week) reversal below zero warning of selling pressure.

CARRY SHORT IN NIFTY FUT .....HEDGE WITH 5200 CALL

CARRY SHORT IN NIFTY FUT .....

HOPE EVERYONE HAVE HEDGED THE SAME WITH 5200 CALLS

IF NOT THEN DO HEDGE WITH 5200 CALL AND CARRY

WE KEEP OUR DOWNSIDE TARGET INTACT

HOPE EVERYONE HAVE BOOKED FULL PROFIT IN

TATASTEEL & JINDAL STEEL & POWER

NIFTY SHORT UPDATE :: JSPL 630>>685 + 55 ::: TATASTEEL 560>>590 +30 POINTS

Keep Holding Short taken on Nifty Spot level btw 5080-5120

with closing basic stop loss of 5156

still we will say this rise is temporary just coz of positive news from europe

Both Stock Recmd on Friday for buying are rocking and in top gainer for the day

Jindal Steel & Power :::: 630>>>685 +55

Tata Steel :::: 560>>>590 +30

We have booked full profit in above two scripts and adding fresh shorts in nifty fut

safe player's can hedge nifty short with 5200 call may 2010

Views & EOD chart Nifty Spot :: Pull back till 5080-5120 before further fall in nifty

Be ready for pull back till 5080-5120 before further fall in nifty...

If wish can book long in tatasteel (560) & jindal steel & power (630) taken on firday on pull back

Around 5080 - 5120 re-enter short on nifty with stop loss 5156 closing basic

for target 4980 / 4920 / 4870 / 4850

No fresh short to be made near or below friday closing

We still keep our target on nifty 4900 intact

Nifty is not below 4830 closing basic considering all bad new till now round world

START BUYING NEAR / BELOW 4900 ... NEXT STOP FOR NIFTY WILL BE 5500-5600

ALL ABOVE SPOT LEVEL'S

::: SWING VOLUME PATTERN CHART::: NIFTY VIEWS & ROAD MAP AHEAD ::: Pull back till 5080-5120 before further fall in nifty

::: ITS ALL ABOUT VOLUME GAME ::: "SWING VOLUME PATTERN CHART"

As guided on thursday night around 9:00pm nifty to fall 2% to 3%... and it was done on firday..

if fall happen ... then expected a bit pull back ... be ready for pull back till 5080-5120

before further fall in nifty...

If wish can book long in tatasteel (560) & jindal steel & power (630) taken on firday on pull back

Around 5080 - 5120 re-enter short on nifty with stop loss 5156 closing basic

for target 4980 / 4920 / 4870 / 4850

No fresh short to be made near or below friday closing

We still keep our target on nifty 4900 intact

Nifty is not below 4830 closing basic considering all bad new till now round world

START BUYING NEAR / BELOW 4900 ... NEXT STOP FOR NIFTY WILL BE 5500-5600

IN MY NEXT POST WILL RECMD FOUR STOCKS THAT CAN BE BOUGHT FOR UP COMMING RALLY

ALSO MENTION ON SVP CHART *.PNG IMAGE FILE

Subscribe to:

Posts (Atom)