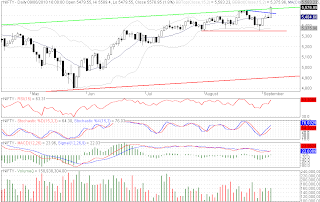

On Monday, market again manage to open above 5500 and

consolidated well between 5520 – 5540 levels, during second-half

market manage to break our level of 5560, as expected above 5560

market hit levels of 5590 and close at 5580. But the volumes in

market were not much as expected.

For the day, the level of 5560 and 5530 may act as a major support

for the market and the level of 5605/5630 may act as a major hurdle.

Short / medium term traders are advisable to start booking profit in

long above 5600-5620 levels. Short / medium term trader can start

building short position in nifty above 5600-5620 level in parts with

stop loss of three consecutive close above 5680.

The medium term trend will turn negative below the level of 5510.

Day trader can go long on nifty above 5590 with stop loss 5475 for

target 5615/5630 and can go short below 5560 with stop loss 5575

for target 5535 /5520.

INDEX RANGE

NIFTY: 5576.95

Range: 5530-5630

Resistance: 5605-5630-5660

Support: 5560-5530-5510

BANK NIFTY: 11218.80

Range: 11050-11380

Resistance: 11265-11320-11380

Support: 11155-11100-11050

Short term: Up (5470)

Medium term: UP (5510)

Long term: Up (5180)

All Above Spot Levels

OM SHRI GANESHAYA NAMAH